Taxism – An Institutionalized Faith & Religion

Part 1. Organization, Finance, and Management

Chapter 1. Organization and Staffing

Section 2. IRS Organizational History

1.1.2 IRS Organizational History

- 1.1.2.1 IRS Organizational History

- 1.1.2.2 National Office

- 1.1.2.3 Regional Offices

- 1.1.2.4 District Offices

1.1.2.1 (02-26-1999)

IRS Organizational History

- The Internal Revenue Service (IRS) organizational history has been well documented in numerous publications, including:

- IRM 1111, Establishment of the Internal Revenue Service, located in IRM 1100, Organization and Staffing, dated September 16, 1993, which is superseded by this section.

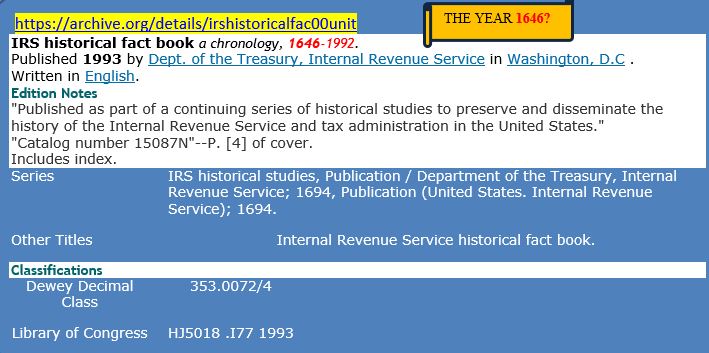

- Publication 1694 (12–92), IRS Historical Fact Book: A Chronology 1646 – 1992.

- The modern IRS organization stems from 1952, when President Truman directed major changes that resulted in the National Office, regional office and district office configuration that continues today.

- The 1952 organization established the three-tier organization, with the Commissioner as the only political appointee, and other employees covered by the civil service. Alcohol and Tobacco was assigned to the IRS, and the Inspection Service was created.

- On January 27, 1998, the Commissioner announced a concept for modernizing the IRS. The first phase, validating and refining the concept, is completed, and design teams are planning the details of the organizational changes which will be implemented during the next few years.

- The IRS Restructuring and Reform Act of 1998 was signed into law on July 22,1998. The Act directs IRS to reorganize from its current structure into a structure that serves groups of taxpayers with similar needs. That reorganization will be implemented gradually beginning in 1999. The Act:

-

- Creates a nine-person Oversight Board to ensure IRS is organized and operated in ways that carry out its mission.

- States the duties of the Commissioner; the Commissioner is appointed to a five-year term of office and may be reappointed; the Commissioner is now required to have a demonstrated ability in management; the Commissioner may appoint and remove personnel from significant management positions; and, the Commissioner is to consult with the Oversight Board on operational functions of the IRS and the selection, evaluation and compensation of senior IRS executives.

- Directs that the Chief Counsel report to the Commissioner except on (1) matters of tax policy where the Chief Counsel reports to the Treasury General Counsel, and (2) on legal advice and interpretations of tax law not relating solely to tax policy (revenue rulings and revenue procedures, technical advice and memoranda, private letter rulings and published guidance not described in the law) and with respect to tax litigation when the Chief Counsel reports to both the Commissioner and the Treasury General Counsel.

- Directs the reorganization of the Taxpayer Advocate to ensure its independence, retitling the position to National Taxpayer Advocate, appointed by the Treasury Secretary. The National Taxpayer Advocate will appoint and evaluate local taxpayer advocates.

- Eliminates the Office of the Chief Inspector (IG) and creates a new National Treasury Inspector General for Tax Administration. The Chief Inspector functions transferred to the Treasury IG for Tax Administration in early 1999.

1.1.2.2 (02-26-1999)

National Office

- In 1952, three assistant commissioners (ACs) were established: Operations, Technical, and Inspection. The Planning and Administration activities alternated between being assistant commissionerships and being assistants to the Commissioner until in 1960 they settled in as assistant commissioners. In 1961, the AC (Data Processing) was established. The AC (Employee Plans and Exempt Organizations) was established in 1974 to carry out the Service’s responsibilities under the Employee Retirement Income Security Act.

- From 1974 to 1982, other than shifting activities between functions, the National Office functions remained basically the same until the 1982 reorganization when three Associate Commissioners were established and a number of changes were made to assistant commissioner titles and functions. A project office for tax processing system redesign was set up in 1982 under the AC (Computer Services); in 1984 that function was established under an AC (Tax System Redesign). In 1986 the AC (Support and Services) was abolished, and the AC (International) was established.

- A major reorganization began in 1993, with the establishment of six chief officers for all National Office functions. In addition, a Chief, Headquarters Operations, was established to manage administrative and support services for the National Office. That configuration was officially approved in January 1994. Since then, modifications have been made to that configuration, such as shifting some functions from one chief officer to another and reducing the number of chief officers to five.

- In the Fall of 1998, the current organization was documented in a Treasury Order to be signed by the Secretary of the Treasury.

1.1.2.3 (02-26-1999)

Regional Offices

- Since regional offices were established in the 1952 reorganization, the existence and number of regional offices has been examined periodically by IRS, Treasury, OMB and outside consultants. Only the number and boundaries changed, from the original seventeen (nineteen were planned) to the seven that continued until October 1995, when seven regions were consolidated into four.

1.1.2.4 (02-26-1999)

District Offices

- Authorized in 1952 to have up to 70 district offices, the largest actual number was 64 districts, during 1952. That number was reduced to 61 by mergers in 1960, then Anchorage District was created in 1961 and four smaller districts were merged with others in 1964. There were no further additions or reductions until the 1980s, when Houston District was established, followed by a Foreign Operations District (FOD) in 1982 (since merged with other operations under an Assistant Commissioner (International)); three new California districts in 1983; and, in 1986, a second district in Florida.

- In 1995 the decision was made to consolidate the districts into 33 offices, which was implemented office-by-office between October 1, 1995 and October 1,1996. In March 1996, the Service initiated further changes to districts by consolidating field support functions.