| “The physical power to get the money does not seem to me a test of the right to tax. Might does not make right, even in taxation.” Justice Jackson in International Harvester Co. v. Department of Taxation, 322 U.S. 435, 450 (1944) |

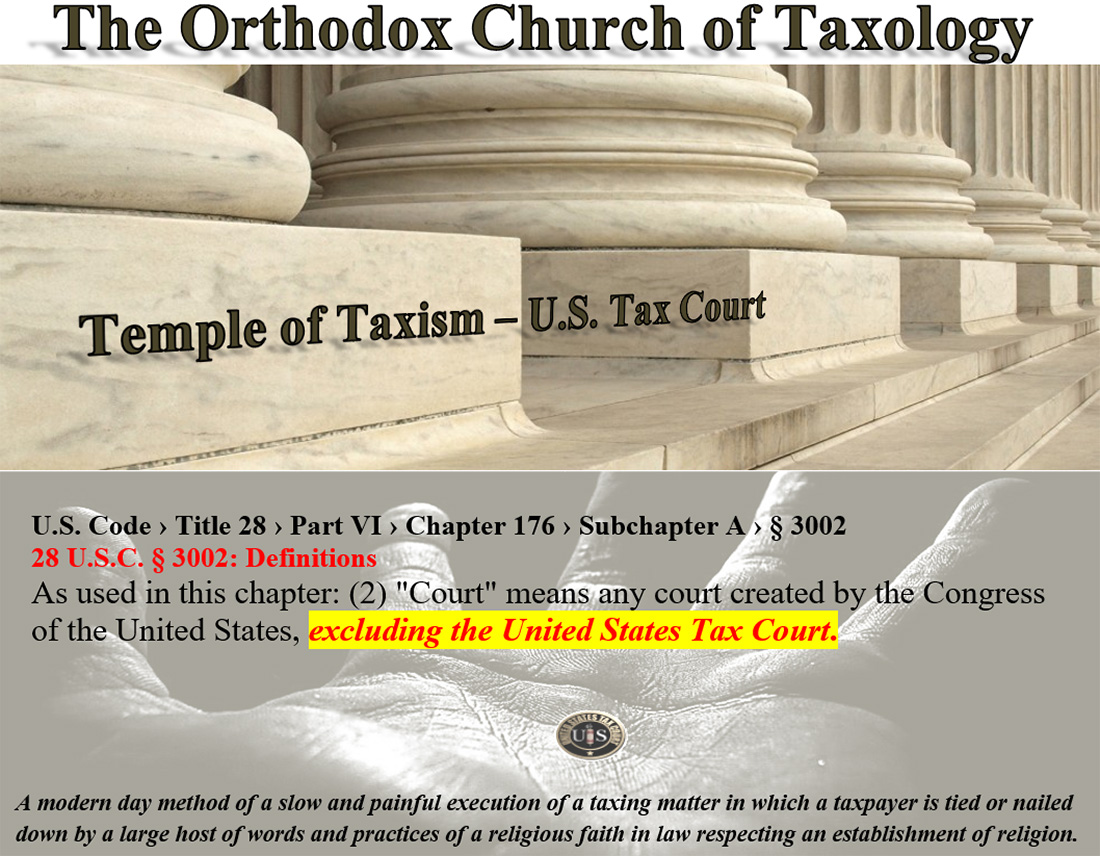

A Temple of Temptations for taxing situations in collecting a tax through census and enumeration, which also bypasses an important Constitutional protection under the Seventh Amendment to have a jury trial.

28 USC 3002: Definitions

Text contains those laws in effect on August 20, 2016

From Title 28-JUDICIARY AND JUDICIAL PROCEDURE

PART VI-PARTICULAR PROCEEDINGS

CHAPTER 176-FEDERAL DEBT COLLECTION PROCEDURE

SUBCHAPTER A-DEFINITIONS AND GENERAL PROVISIONS

-3002. Definitions

As used in this chapter:

(1) “Counsel for the United States” means-

(A) a United States attorney, an assistant United States attorney designated to act on behalf of the United States attorney, or an attorney with the United States Department of Justice or with a Federal agency who has litigation authority; and

(B) any private attorney authorized by contract made in accordance with section 3718 of title 31 to conduct litigation for collection of debts on behalf of the United States.

(2) “Court” means any court created by the Congress of the United States, excluding the United States Tax Court.

(3) “Debt” means-

(A) an amount that is owing to the United States on account of a direct loan, or loan insured or guaranteed, by the United States; or

(B) an amount that is owing to the United States on account of a fee, duty, lease, rent, service, sale of real or personal property, overpayment, fine, assessment, penalty, restitution, damages, interest, tax, bail bond forfeiture, reimbursement, recovery of a cost incurred by the United States, or other source of indebtedness to the United States, but that is not owing under the terms of a contract originally entered into by only persons other than the United States;

and includes any amount owing to the United States for the benefit of an Indian tribe or individual Indian, but excludes any amount to which the United States is entitled under section 3011(a).

(4) “Debtor” means a person who is liable for a debt or against whom there is a claim for a debt.

(5) “Disposable earnings” means that part of earnings remaining after all deductions required by law have been withheld.

(6) “Earnings” means compensation paid or payable for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a pension or retirement program.

(7) “Garnishee” means a person (other than the debtor) who has, or is reasonably thought to have, possession, custody, or control of any property in which the debtor has a substantial nonexempt interest, including any obligation due the debtor or to become due the debtor, and against whom a garnishment under section 3104 or 3205 is issued by a court.

(8) “Judgment” means a judgment, order, or decree entered in favor of the United States in a court and arising from a civil or criminal proceeding regarding a debt.

(9) “Nonexempt disposable earnings” means 25 percent of disposable earnings, subject to section 303 of the Consumer Credit Protection Act.

(10) “Person” includes a natural person (including an individual Indian), a corporation, a partnership, an unincorporated association, a trust, or an estate, or any other public or private entity, including a State or local government or an Indian tribe.

(11) “Prejudgment remedy” means the remedy of attachment, receivership, garnishment, or sequestration authorized by this chapter to be granted before judgment on the merits of a claim for a debt.

(12) “Property” includes any present or future interest, whether legal or equitable, in real, personal (including choses in action), or mixed property, tangible or intangible, vested or contingent, wherever located and however held (including community property and property held in trust (including spendthrift and pension trusts)), but excludes-

(A) property held in trust by the United States for the benefit of an Indian tribe or individual Indian; and

(B) Indian lands subject to restrictions against alienation imposed by the United States.

(13) “Security agreement” means an agreement that creates or provides for a lien.

(14) “State” means any of the several States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Marianas, or any territory or possession of the United States.

(15) “United States” means-

(A) a Federal corporation;

(B) an agency, department, commission, board, or other entity of the United States; or

(C) an instrumentality of the United States.

(16) “United States marshal” means a United States marshal, a deputy marshal, or an official of the United States Marshals Service designated under section 564.

(Added Pub. L. 101–647, title XXXVI, §3611, Nov. 29, 1990, 104 Stat. 4933.)

REFERENCES IN TEXT

Section 303 of the Consumer Credit Protection Act, referred to in par. (9), is classified to section 1673 of Title 15, Commerce and Trade.

https://uscode.house.gov/view.xhtml?req=(title:28 section:3002 edition:prelim) OR (granuleid:USC-prelim-title28-section3002)&f=treesort&edition=prelim&num=0&jumpTo=true

| ||

| United States Tax Court, 400 Second Street, NW, Washington, DC 20217 Telephone: 202-521-0700 | ||

Fasces (/ˈfæsiːz/, (Italian: Fasci, Latin pronunciation: [ˈfa.skeːs], a plurale tantum, from the Latin word fascis, meaning “bundle”) is a bound bundle of wooden rods, sometimes including an axe with its blade emerging. The fasces had its origin in the Etruscan civilization, and was passed on to ancient Rome, where it symbolized a magistrate’s power and jurisdiction. The image has survived in the modern world as a representation of magisterial or collective power. https://en.wikipedia.org/wiki/Fasces |  |  |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

RULE 1. RULEMAKING AUTHORITY

- Rulemaking Authority: The United States Tax Court, after giving appropriate public notice and an opportunity for comment, may make and amend rules governing its practice and procedure.